Top 15 Client Bookkeeping Solutions to Simplify Your Finances

Client bookkeeping solutions giving you headaches? You’re not alone. A SCORE survey shows that 40% of small business owners feel financially illiterate, and this can lead their businesses to get pricey mistakes.

The numbers paint a concerning picture. The IRS reports that 60% of small businesses make errors in their bookkeeping. These mistakes create financial inefficiencies and potential risks. But here’s the silver lining – a PwC study found that 86% of businesses using digital bookkeeping solutions experienced fewer errors and increased efficiency. On top of that, 85% of businesses say automation boosts their productivity by a lot.

New founders often skip proper bookkeeping and end up regretting it later. Simple records can paint a clear picture of your business performance. The AI-driven accounting market will reach $41.7 billion by 2026. This makes it the perfect time to explore bookkeeping software options that match your needs.

This piece walks you through 15 smart client bookkeeping solutions. These range from simple systems for startups to advanced platforms for businesses that are years old. You’ll find the right tool to revolutionize your financial record-keeping, whether you need simple expense tracking or detailed financial management.

[ez-toc]

Why the Right Bookkeeping Software Matters

Picking the right bookkeeping software is more than a technical choice – it’s a strategic move that will affect your business’s financial accuracy, efficiency, and growth. Poor choices can ripple through your entire operation, while the right solutions can revolutionize how you handle finances.

Good bookkeeping software cuts down human error in financial records significantly. Manual bookkeeping naturally leads to mistakes that mess up financials and create compliance issues. Automated systems fix this problem by processing and calculating data consistently. This precision becomes crucial during tax season when every number must be right.

Your team’s productivity can jump up to 20% with the right accounting software. The system takes care of repetitive work like invoicing, payroll, and financial reports. Your staff can focus on growing the business and serving clients better instead.

Live visibility into your financial health stands out as a key advantage. Modern software gives you instant access to dashboards and reports. You can track cash flow, check profitability, and spot trends right away. This means you’ll make smarter decisions based on current numbers, not old reports.

Your industry shapes what you need from a bookkeeping solution. Law firms need different financial tracking tools than manufacturing or logistics companies. A complete package often brings together core accounting features with payroll, billing, and project management tools that fit your field.

Business growth demands flexible financial tools. Adaptable bookkeeping software will grow with your business. Today’s solutions also come with strong security – encryption and user controls keep your financial data safe.

The right bookkeeping system sets you up for success now and later through better accuracy, time savings, and smart insights.

1. QuickBooks Online

QuickBooks Online dominates the US accounting software market with an 80% share. This cloud-based powerhouse provides strong financial management capabilities that don’t need local installation.

Features of QuickBooks Online

QuickBooks Online provides detailed bookkeeping features that expand as your business grows:

- Invoice Management: Create custom professional invoices, send payment reminders, and automatically match payments to invoices

- Expense Tracking: Record expenses for tax time and photograph receipts with the mobile app

- Banking Integration: Automatically download transactions from your bank and credit cards nightly

- Financial Reporting: Access over 65+ built-in business reports on the Plus plan

- Inventory Management: Track product levels, monitor cost of goods, and receive low-stock notifications

- Project Profitability: View detailed dashboards showing labor costs, payroll, and expenses per project

Benefits of QuickBooks Online

QBO stands out from desktop alternatives with several key advantages:

Cloud-based architecture lets you access your accounts from any internet-connected device. Your data remains secure and updated across all devices.

The platform makes shared work easier—accountants can access your books without backup copies. You can add up to 25 users with custom permissions on the Advanced plan.

The system combines smoothly with over 650 business apps including Bill.com, Expensify, and PayPal.

Pricing of QuickBooks Online

QuickBooks Online matches different business needs with tiered pricing:

- Simple Start: $17.50/month (first 3 months, then $35/month) – 1 user

- Essentials: $32.50/month (first 3 months, then $65/month) – 3 users

- Plus: $49.50/month (first 3 months, then $99/month) – 5 users

- Advanced: $117.50/month (first 3 months, then $235/month) – 25 users

Best Use Case for QuickBooks Online

QuickBooks Online shines especially when service-based businesses need remote access and financial visibility. The platform’s strength comes from its advanced financial insights through customizable analytics tools.

Growing businesses that need simple bookkeeping and adaptable features will find QBO a perfect fit. The platform evolves alongside your business—from simple expense tracking to detailed financial management with automated workflows.

2. Xero Software

Xero has evolved into a global cloud accounting platform since its launch in 2006. The platform now serves over two million subscribers in more than 180 countries. Small businesses can manage their finances without complex setups through this accessible system.

Features of Xero Software

Xero’s complete accounting tools make financial management simple:

- Automated Bank Reconciliation: Connects to 21,000+ global institutions, saves hours through transaction matching

- Intuitive Invoicing: Sends professional invoices, automates reminders, tracks payment status

- Expense Management: Captures receipts digitally, makes reimbursement efficient

- Multi-Currency Support: Handles 160+ currencies with hourly exchange rate updates

- Inventory Tracking: Monitors stock levels, populates invoices with bought and sold items

- Mobile Accessibility: Manages finances through mobile apps anywhere

Benefits of Xero Software

The platform’s accessible interface makes it easy for users with minimal accounting experience to manage their finances. Users can make confident decisions about purchases and expenses through direct bank connections that provide up-to-the-minute data analysis.

Xero combines smoothly with over 800 third-party applications. This vast ecosystem lets you customize your workflow and connect your existing business tools for efficient operations.

Pricing of Xero Software

Xero’s three subscription tiers (prices effective until October 1, 2025):

- Early: $20/month – Has 20 invoices/5 bills limit, simple reporting

- Growing: $47/month – Unlimited invoices/bills, bulk reconciliation

- Established: $80/month – Adds multi-currency, project tracking, expense claims

Best Use Case for Xero Software

Small to medium businesses that need shared access across multiple locations will find Xero valuable. Companies with international operations benefit from its multi-currency features. Service-based companies value its project tracking capabilities, while product-based businesses appreciate the inventory management features. Businesses looking for an accessible platform that grows with them without requiring accounting expertise will find Xero ideal.

3. FreshBooks

FreshBooks stands out as an easy-to-use accounting platform designed for service-based businesses and freelancers. This cloud solution focuses on making financial management simple yet professional.

Features of FreshBooks

FreshBooks comes packed with tools that make bookkeeping quick and simple:

- Customizable Invoicing: Create professional invoices with customizable templates, colors, and fonts that match your brand identity

- Time Tracking: Track billable hours using a one-click timer that works on all your devices

- Expense Management: Import bank transactions and scan receipts right from your phone

- Client Management: Keep client contact details and track your relationship history

- Project Tracking: See project profits and cooperate with team members

Benefits of FreshBooks

FreshBooks saves countless hours by automating invoicing, expense tracking, and bank reconciliation. Your financial records stay accurate since you won’t need manual data entry.

The platform helps improve cash flow with built-in online payment processing. Clients can pay their invoices directly using credit cards or bank transfers.

Small business owners without accounting knowledge find FreshBooks easy to use. One user shares, “I found it was too much for me, as I do not have an accounting background, and own a small business… I decided on Freshbooks. I could not be happier”.

Pricing of FreshBooks

FreshBooks pricing tiers look like this (as of August 2025):

- Lite: $21/month – Up to 5 billable clients

- Plus: $38/month – Up to 50 billable clients

- Premium: $65/month – Unlimited clients

- Select: Custom pricing – Enterprise-level features

Best Use Case for FreshBooks

Freelancers, contractors, and service-based small businesses who need simple financial management will love FreshBooks. The software works best for businesses that bill clients by the hour since all plans include unlimited invoicing, expense tracking, and time tracking. Companies moving away from manual bookkeeping appreciate how easy it is to learn and use FreshBooks on their mobile devices.

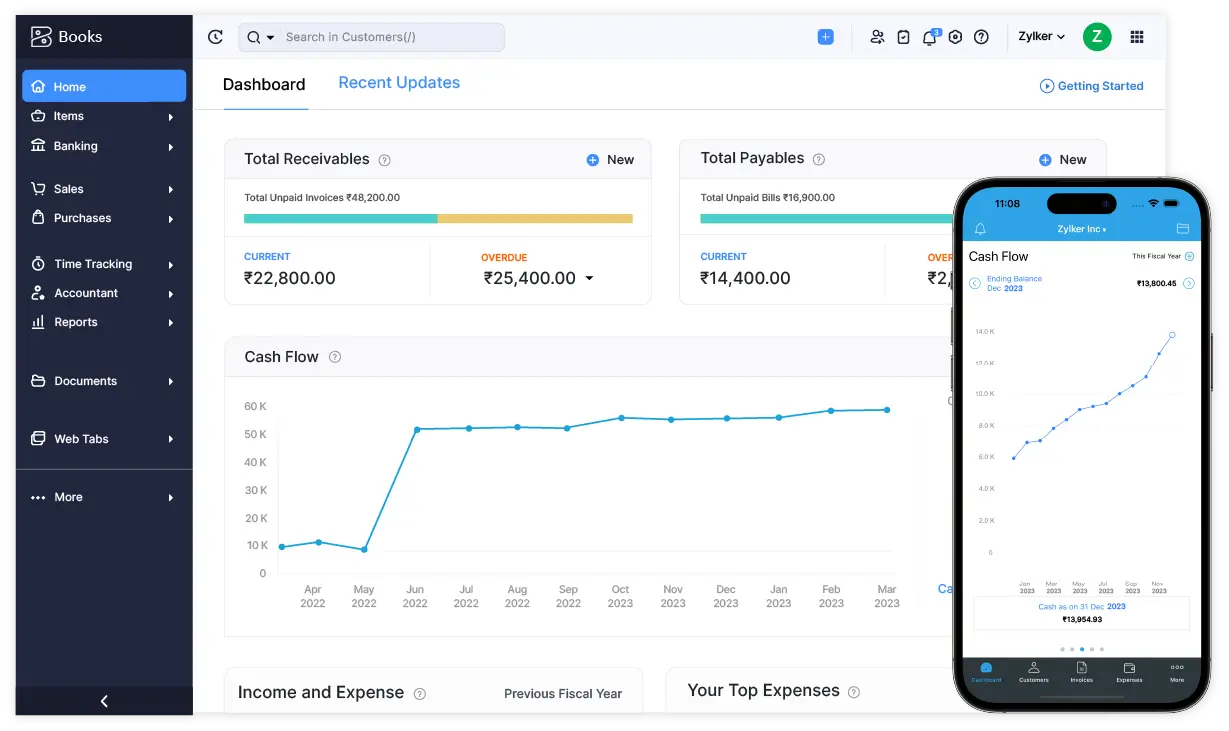

4. Zoho Books

Zoho Books provides complete accounting with a user-friendly interface that simplifies financial management for businesses of all sizes. Businesses can automate their processes while retaining control over finances with this detailed client bookkeeping solution.

Features of Zoho Books

This strong bookkeeping software comes packed with powerful capabilities:

- Invoicing & Estimates: Create custom invoices, automate payment reminders, and enable self-service customer portals

- Expense Management: Track expenses, scan receipts, and set up recurring expenses

- Banking Tools: Connect bank feeds and perform automated reconciliation for faster month-end closing

- Inventory Control: Track stock levels, create price lists, and manage warehouses with batch tracking in higher plans

- Project Accounting: Set budgets, track timesheets, and analyze project profitability

Benefits of Zoho Books

Businesses have cut their invoicing and expense tracking time by 40% through automation features. The customizable customer portal makes client interactions easier by providing a secure location to view transactions and make payments.

The vendor portal lets suppliers upload invoices and track payment status without long email chains. The extensive integration ecosystem connects with 55+ Zoho apps and payment gateways like Stripe and PayPal.

Pricing of Zoho Books

The software’s pricing structure starts with a free plan for businesses earning under $50,000. Paid plans begin at $15/month with the Standard plan when billed annually. Professional ($40/month), Premium ($60/month), Elite ($120/month), and Ultimate ($240/month) plans offer additional features.

Best Use Case for Zoho Books

Small businesses looking for affordable yet feature-rich accounting will find Zoho Books ideal. The platform’s global capabilities benefit organizations that need multi-currency transactions. Businesses with complex vendor relationships will appreciate its simplified purchase management features.

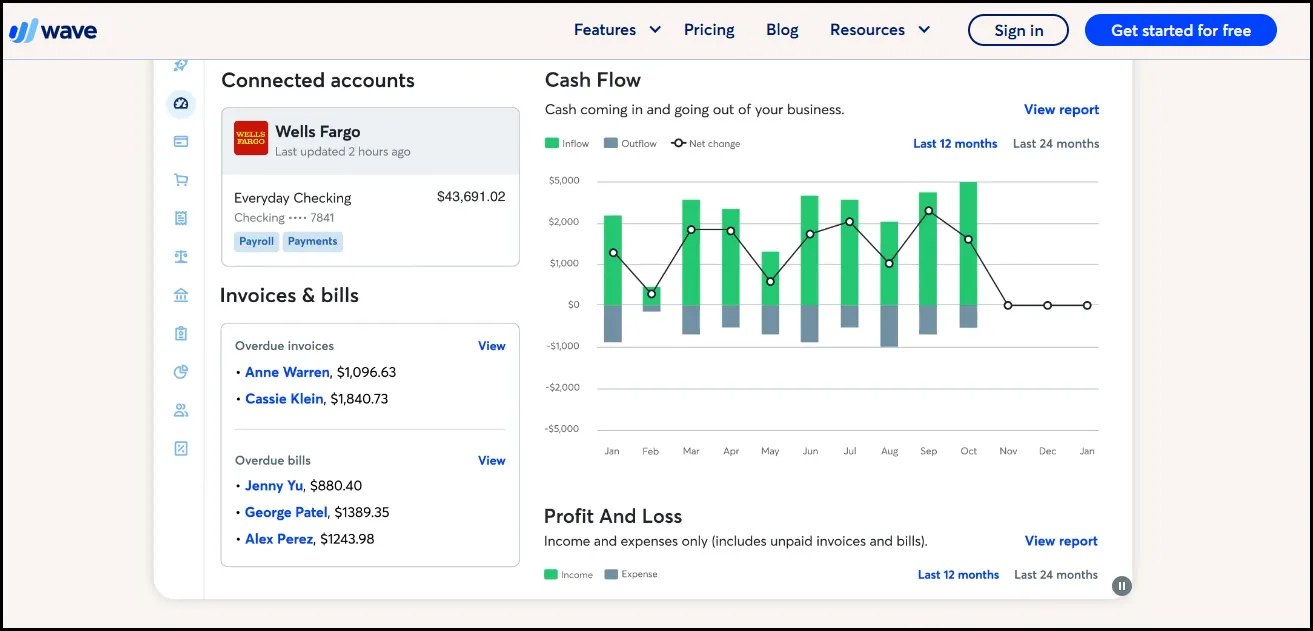

5. Wave Accounting

Wave Accounting emerges as a powerful option if you run a small business and need affordable client bookkeeping solutions. The platform has earned the trust of over 350,000 small businesses by making their financial management simpler.

Features of Wave Accounting

Wave gives you detailed capabilities to help you manage your finances:

- Invoicing Tools: Create professional, customizable invoices with automated payment reminders and tracking

- Expense Management: Connect bank accounts and get automatic transaction imports and categorization

- Receipt Scanning: Capture up to 10 receipts at once with unlimited scanning capacity

- Double-Entry Accounting: Keep professional-grade books that accountants love

- Financial Reporting: Get detailed reports including profit & loss statements, balance sheets, and cash flow statements

- Bank Reconciliation: Make reconciliation easier through automated processes and transaction matching

Benefits of Wave Accounting

Wave’s accessible design brings remarkable advantages. The platform works right from your browser with just an internet connection. Your financial data stays secure with 256-bit SSL encryption and PCI-DSS Level 1 service provider status.

Pricing of Wave Accounting

Wave has two main plans:

- Starter: Free – Has unlimited invoicing, bills, and bookkeeping records

- Pro: $19/month – Adds discounted payment processing, auto-import bank transactions, and unlimited receipt scanning

You can also get payment processing (starting at 2.9% + $0.60 per transaction) and payroll services ($20-40/month plus $6 per employee/month).

Best Use Case for Wave Accounting

Wave works best for entrepreneurs who need strong invoicing capabilities. Small service-based businesses, freelancers, and contractors with few employees will find it perfect. The platform shines when you need professional invoicing—users report zero unpaid invoices thanks to Wave’s simplified system.

6. NetSuite ERP

NetSuite ERP is a detailed cloud-based solution that integrates and automates key financial and operational processes. This all-in-one system helps organizations work better with its AI-powered capabilities.

Features of NetSuite ERP

NetSuite ERP delivers powerful functionality in several areas:

- Financial Management: Transforms your general ledger, optimizes accounts receivable, automates accounts payable, and simplifies tax management

- Inventory Management: Automates inventory tracking across locations, determines reorder points, and optimizes safety stock

- Order Processing: Eliminates manual bottlenecks and prevents errors from sales quote to fulfillment

- Supply Chain Management: Simplifies moving goods through extended supply chains whatever the production or storage location

- Warehouse Operations: Offers RF-device-directed putaway and picking tasks with advanced capabilities like wave management

Benefits of NetSuite ERP

NetSuite optimizes operational efficiency through simplified processes and automation of manual tasks. The platform provides better reporting capabilities that enable smarter decisions based on immediate financial data. Companies gain improved visibility into operations with integrated information throughout their organization.

Pricing of NetSuite ERP

The annual license fee includes three parts: core platform, optional modules, and number of users, plus a one-time implementation fee. NetSuite offers customized pricing based on business size, complexity, and required features instead of using a one-size-fits-all approach.

Best Use Case for NetSuite ERP

We designed NetSuite ERP for midmarket and high-growth companies that want to scale without overwhelming their finance teams. The platform works well for multi-entity or multinational organizations with complex accounting needs. Service, SaaS, ecommerce, manufacturing, and nonprofit businesses looking to reduce their dependence on disconnected finance tools will find NetSuite particularly valuable.

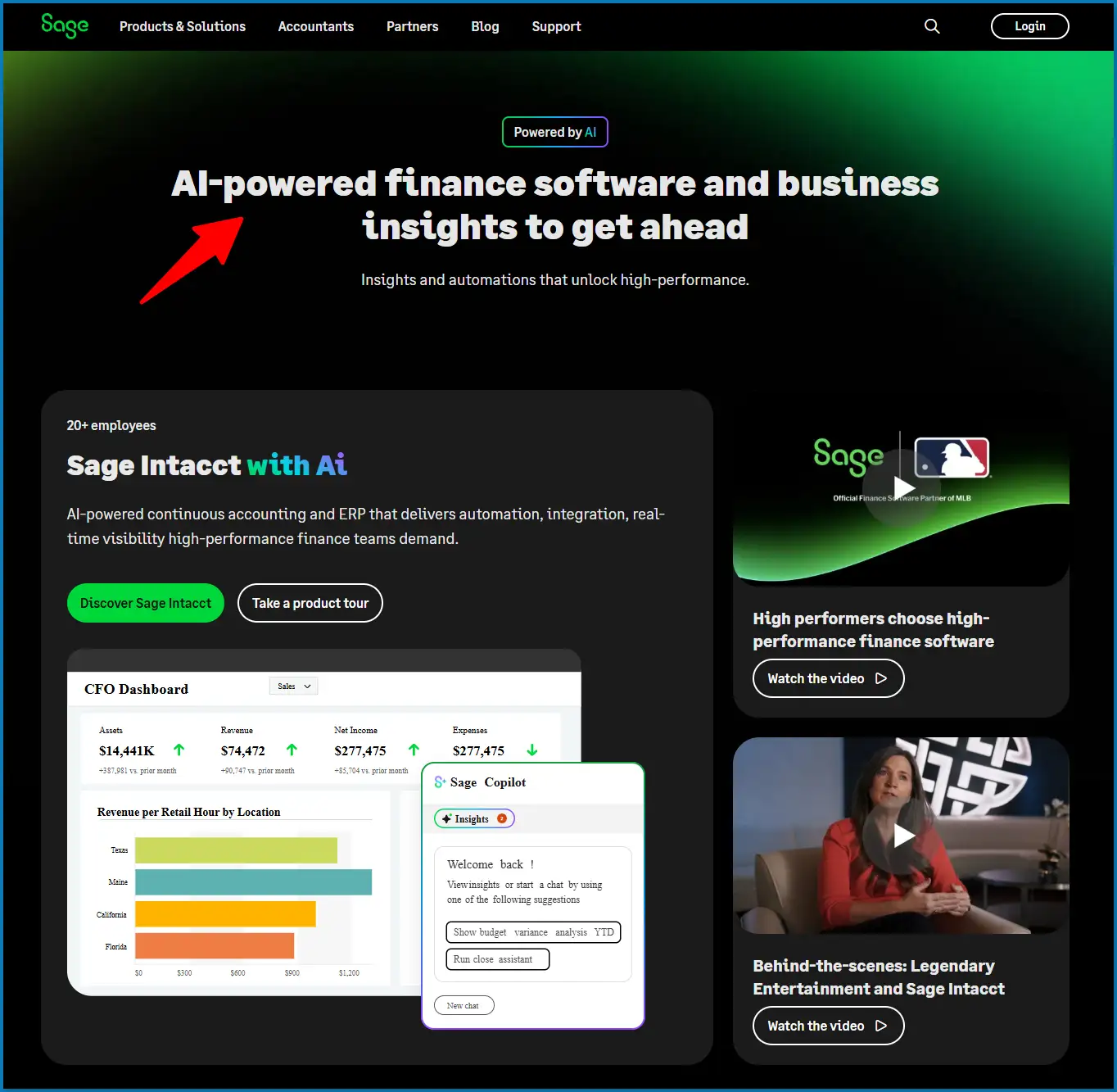

7. Sage Intacct

Sage Intacct’s cloud-based solution lifts financial management through AI-powered automation. The platform serves as a strong client bookkeeping solution for growing businesses.

Features of Sage Intacct

Sage Intacct provides detailed functionality through:

- Core Financial Management: Has general ledger, accounts payable/receivable, cash management, purchasing, and invoicing

- Advanced Modules: Has fixed assets, inventory tracking, revenue recognition, project accounting, and dynamic allocations

- AI-Powered Tools: Features AP automation, Sage Copilot for variance analysis, and intelligent GL outlier detection

- Multi-Entity Capabilities: Makes complex consolidations simpler across multiple currencies and locations

Benefits of Sage Intacct

Sage Intacct’s design brings substantial improvements to organizations. The dimensional analysis feature lets you tag transactions by customer, department, and location to get deeper financial insights.

Customizable dashboards provide up-to-the-minute structured data and eliminate complex manual calculations.

Pricing of Sage Intacct

Basic configuration with two business users starts at $9,000 for annual subscription. Most customers spend between $15,000-$35,000 annually. Implementation costs typically range from 1-1.5x the annual subscription fee.

Best Use Case for Sage Intacct

Mid-sized companies with complex accounting needs find Sage Intacct extremely useful. The solution works best for professional services firms that need project profitability tracking. Multi-entity businesses can cut their processing time in half with simplified consolidations.

8. ZipBooks

ZipBooks combines smart automation with features that accelerate growth to change traditional client bookkeeping. The cloud-based platform makes complex financial tasks simpler through accessible design.

Features of ZipBooks

ZipBooks provides detailed functionality to manage finances quickly:

- Smart Invoicing: Create customizable invoices, send payment reminders, and accept payments via Square or PayPal

- Intelligent Bookkeeping: Automates categorization with individual-specific machine learning and industry-best chart of accounts

- Time Tracking: Monitor billable hours with live tracking or manual entry options

- Team Collaboration: Add team members with customized permissions for various functions

- Financial Reporting: Generate income statements, balance sheets, and custom tag-based reports

Benefits of ZipBooks

ZipBooks’ design delivers real advantages to users. The platform cuts bookkeeping time by 15%. On top of that, its accessible interface helps users without accounting backgrounds manage finances.

Pricing of ZipBooks

ZipBooks comes in four pricing tiers:

- Starter: Free – Unlimited invoices, simple reports, one bank connection

- Smarter: $15/month – Recurring invoices, auto-bill, multiple bank connections

- Sophisticated: $35/month – Smart tagging, document sharing, unlimited users

- Accountant: Custom pricing – Client management dashboard, bulk editing

Best Use Case for ZipBooks

Small businesses that need both accounting features and revenue growth tools will find ZipBooks most valuable. Service companies benefit from its project tracking capabilities. The platform ended up serving entrepreneurs who need straightforward yet powerful bookkeeping without deep accounting knowledge.

9. FreeAgent

FreeAgent brings cloud-based accounting simplicity to small businesses and freelancers without compromising on professional features. The platform stands out with its accessible interface that simplifies financial management.

Features of FreeAgent

FreeAgent comes with detailed financial management tools:

- Smart Invoicing: Set up recurring invoices and get automated reminders when payments are late

- Expense Tracking: Take photos of receipts on your phone and sort them into categories that work for you

- Project Management: See your entire project at a glance – from invoices and expenses to tasks and time tracking

- Bank Integration: Link your online accounts to import transactions automatically and get live financial updates

- Tax Management: The system calculates your self-assessment, corporation tax, and VAT returns automatically

Benefits of FreeAgent

The software cuts down bookkeeping time by 15% with its automation features. You can check your business health quickly with a customizable dashboard that shows instant financial insights. The platform makes shared work with accountants easier, leading to better financial guidance.

Pricing of FreeAgent

- US version: $24.00/month with a special offer of $12.00/month for the first 6 months

- Start a 30-day free trial without entering credit card details

Best Use Case for FreeAgent

Freelancers, contractors, and service-based small businesses looking for simple financial management will find FreeAgent perfect for their needs. The software proves especially valuable when you have to track project profitability and time-based billing.

10. Gusto

Gusto is a detailed payroll and HR platform that merges with your client’s bookkeeping solutions. The cloud-based system helps over 400,000 small and medium-sized businesses nationwide.

Features of Gusto

Gusto provides more than simple bookkeeping:

- Automated Payroll Processing: Run unlimited payroll with automatic tax calculations, filings, and payments across all 50 states

- Employee Management: Digital onboarding, self-service portals for paystubs, and lifetime access to documents

- Benefits Administration: Health insurance, 401(k) plans, workers’ compensation, and tax-advantaged accounts that sync with payroll

- Time Tracking: Integration with leading time-tracking partners for automated hour imports

Benefits of Gusto

Businesses save over 80 hours each year on payroll tasks with Gusto’s efficient approach. The platform’s users report 88% better regulatory compliance. Automatic tax filing services come at no extra cost, and the system reduces manual errors significantly.

Pricing of Gusto

Gusto’s pricing structure is clear and straightforward:

- Simple: $49/month + $6/person – Single-state payroll, basic reporting

- Plus: $80/month + $12/person – Multi-state payroll, next-day deposits, time tracking

- Premium: $180/month + $22/person – Dedicated support, HR experts, advanced analytics

- Contractor Only: Free base price for first 6 months (normally $35) + $6/contractor

Best Use Case for Gusto

Small to medium businesses that need simple payroll management and bookkeeping tools benefit from Gusto. The platform’s accessible interface and tax compliance features work well for tech startups, restaurants, professional services firms, and nonprofits.

11. Keeper App

Keeper App makes client management easier for accounting and bookkeeping firms with its detailed portal system. The solution creates efficient communication between bookkeepers and their clients.

Features of Keeper App

Keeper App has everything you need for bookkeeping:

- File review reports and client portal management

- Detailed reporting and task management capabilities

- Custom-branded client portal (Premium plan)

- Smoothly combined email and text messaging

- Time tracking and direct vendor W-9 requests

Benefits of Keeper App

Bookkeeping firms become more organized with Keeper’s systematic approach. “It makes it so easy to ask your clients questions about sensitive data without having to email/call/text,” notes one user. Keeper’s QuickBooks Online integration connects directly to client ledgers. This enables faster client responses and efficient file reviews.

Pricing of Keeper App

Keeper’s pricing is straightforward and based on clients:

- Standard: $8.00 per client/month – Has core features

- Premium: $10.00 per client/month – Adds custom branding and combined messaging

- Enterprise: Custom pricing for practices with 50+ clients

Additional options include Keeper Receipts ($15/client/month) and Tax Suite to manage tax and bookkeeping together.

Best Use Case for Keeper App

Keeper App works best for bookkeeping practices with multiple clients using QuickBooks Online or Xero. The platform helps practices improve client communication and workflow management, whether you’re a solopreneur or large accounting firm.

12. Daily Keeper

Daily Keeper is a simple expense tracking app that works with detailed client bookkeeping solutions. The app helps users manage their personal finances without complexity.

Features of Daily Keeper

Daily Keeper comes with practical tools to track your finances:

- Quick expense recording that works like a pocket notebook

- A category system with colorful icons you can spot easily

- Detailed reports showing daily, monthly, and yearly spending

- Options to export data to PDF or Excel for your accountant

- Google Drive backup to keep your data safe

Benefits of Daily Keeper

The app’s user-friendly design makes money tracking simple even without bookkeeping knowledge. The pie charts turn complex numbers into easy-to-understand visuals. Users can see their spending patterns right away.

Pricing of Daily Keeper

You can download the app free and use its core features immediately. Premium features come as optional in-app purchases, but the free version gives you everything you need to track expenses.

Best Use Case for Daily Keeper

Daily Keeper works best if you need to manage both personal and small business expenses. The app lets professionals separate their business costs from personal spending with multiple profiles. People who prefer visual money insights over spreadsheets will find this app particularly useful.

Client Bookkeeping Solutions Software

Client Bookkeeping Solution (CBS) creates a smooth connection between daily bookkeeping tasks and professional accounting services for accounting firms and their clients. The software builds stronger client relationships through customizable functionality and integrated workflow.

Features of Client Bookkeeping Solutions Software

CBS gives clients these key capabilities:

- Daily checkwriting and transaction recording that works for cash and accrual-basis clients

- Online banking integration with vendor and payroll direct deposit through InterceptEFT

- CBS ASP technology allows access from anywhere, anytime

- Multiple employees can work simultaneously with multi-user access

Benefits of Client Bookkeeping Solutions Software

CBS connects smoothly with Write-Up CS, UltraTax CS, and Practice CS for efficient data transfer. Accountants can view client transactions remotely and make adjustments to client data while answering questions. Clients gain better control over cash flow and daily bookkeeping tasks.

Pricing of Client Bookkeeping Solutions Software

Licensed Write-Up CS accountants with CBS Master License offer this software exclusively, and firms set their client’s fees independently.

Best Use Case for Client Bookkeeping Solutions Software

Accounting practices that want oversight while giving clients user-friendly bookkeeping tools will find CBS ideal. Clients handle daily tasks and send period-end data through email, diskette, or online retrieval in a typical workflow.

Bookkeeping and Payroll Services

Businesses can save money and gain expertise by using outsourced bookkeeping and payroll services instead of hiring in-house staff. Research shows that 40% of small business owners say bookkeeping and taxes are their biggest challenge when running their company.

Features of Bookkeeping and Payroll Services

Professional services come with these key elements:

- Full financial record-keeping and transaction tracking

- Monthly financial reports like balance sheets and P&L statements

- Bank account matching across multiple accounts

- Processing vendor bills and creating customer invoices

- Calculating wages, withholding taxes, and sending paychecks

- Managing tax filing and compliance

Benefits of Bookkeeping and Payroll Services

Outsourcing these tasks brings many advantages. We saved valuable time—24% of small businesses report higher efficiency as their top reason to outsource. Good record-keeping helps avoid mistakes that get pricey and keeps you tax compliant. Detailed financial records also help you learn about your company’s performance and make smarter business decisions.

Pricing of Bookkeeping and Payroll Services

Service providers usually bill monthly or charge by the hour ($65/hour without packages). Monthly plans start under $100 and can reach thousands of dollars based on your business size and needed services. Payroll costs increase with employee numbers—ranging from $200/month for 1-10 employees to $550/month for 26-40 employees.

Best Use Case for Bookkeeping and Payroll Services

Growing businesses that want professional financial management without a full-time staff will benefit from these services. Companies operating in multiple states also find value in outsourced expertise that handles compliance requirements across different locations.

Industry-Specific Bookkeeping Software

Standard bookkeeping solutions work well for many businesses, but some industries need specialized financial tracking tools that match their operations. Traditional accounting practices don’t deal very well with specific challenges businesses face in a variety of sectors.

Restaurant365 gives restaurant owners specialized features that merge POS systems with recipe costing and inventory management. Construction companies’ operations require software to handle project-based accounting, subcontractor management, and job costing.

The healthcare sector needs distinct solutions to manage patient billing, insurance claims, and compliance with national healthcare laws. Manufacturing businesses rely on specialized tools to track production costs and manage raw materials.

These industry-specific accounting tools come with their own drawbacks. One expert points out, “Industry-specific accounting software typically fails at fully delivering quality accounting functionality”.

Many businesses have found success by combining industry-focused applications with dedicated accounting systems. This strategy lets companies use specialized industry tools alongside reliable financial management systems.

Your company’s unique operational needs should drive the decision to invest in industry-specific bookkeeping software. The basic accounting statements look similar across industries, but the transactions behind these reports differ significantly. The best solution depends on your business’s operational requirements rather than just its industry category.

FAQs About Bookkeeping Software

Businesses often ask these questions while selecting client bookkeeping solutions. Let’s address the most common questions about bookkeeping software:

Should I choose cloud-based or desktop accounting software? Cloud-based tools give you live access, collaboration features and automatic updates. Desktop software needs manual updates, restricts access to one device and has limited integration options.

Can QuickBooks be set up without professional help? DIY setups often miss significant elements like proper chart of accounts structure and opening balances. Simple businesses can manage self-setup well, but complex operations need professional guidance.

What reports should I regularly review in my bookkeeping software? Monthly reviews should include: Profit & Loss Statement that shows profitability, Balance Sheet displaying financial health, and Cash Flow Report tracking money movement. Businesses that invoice clients should also watch their Accounts Receivable Aging report closely.

Why submit a backup file versus exporting to Excel? Backup files help examiners verify original electronic records’ integrity, which Excel spreadsheets cannot provide. Original formats make proper evaluation of accounting systems and internal controls possible.

What features should I look for in bookkeeping software? Your software should have bank feed integrations, mobile accessibility, simple dashboards, invoicing capabilities, expense tracking and financial reporting.

Bookkeeping Software Comparison Table: Features & Pricing at a Glance

| Solution Name | Key Features | Pricing (2025) | Best For | Notable Benefits |

|---|---|---|---|---|

| QuickBooks Online | – Invoice Management – Expense Tracking – Banking Integration – 65+ Built-in Reports – Inventory Management |

– Simple Start: $35/mo – Essentials: $65/mo – Plus: $99/mo – Advanced: $235/mo |

Service businesses that need remote access | – Access anywhere in the cloud – Works with 650+ apps – Teams can work together |

| Xero | – Automated Bank Reconciliation – Multi-Currency Support – Inventory Tracking – Mobile Accessibility |

– Early: $20/mo – Growing: $47/mo – Established: $80/mo |

Small and medium businesses doing international trade | – Easy to use interface – Live financial data – Connects with 800+ apps |

| FreshBooks | – Customizable Invoicing – Time Tracking – Expense Management – Project Tracking |

– Lite: $21/mo – Plus: $38/mo – Premium: $65/mo – Select: Custom |

Freelancers, contractors, and small service providers | – Saves time with automation – Better cash flow – User-friendly design |

| Zoho Books | – Invoicing & Estimates – Expense Management – Banking Tools – Inventory Control |

– Free (revenue under $50k) – Standard: $15/mo – Professional: $40/mo – Premium: $60/mo |

Small businesses looking for affordable full-featured accounting | – 40% faster invoicing – Works with many apps – Vendor portal |

| Wave Accounting | – Invoicing Tools – Expense Management – Receipt Scanning – Double-Entry Accounting |

– Starter: Free – Pro: $19/mo |

Solo workers and very small service businesses | – Works right away – 256-bit SSL encryption – No limit on invoices |

| NetSuite ERP | – Financial Management – Inventory Management – Order Processing – Supply Chain Management |

Custom pricing based on business size and complexity | Growing mid-sized companies | – Faster operations – Better reporting – Live business updates |

| Sage Intacct | – Core Financial Management – Advanced Modules – AI-Powered Tools – Multi-Entity Capabilities |

Starting at $9,000/year | Mid-sized companies with complex accounting | – Deep financial analysis – Live dashboards – Easier consolidation |

Final Thoughts: Start Simple, Grow Smart

Your business success depends on picking the right bookkeeping solution. This guide shows you options from free platforms like Wave Accounting to complete enterprise systems like NetSuite ERP. Each solution has advantages that match specific business needs at different growth stages.

Every business needs accurate financial records. Using the right bookkeeping software cuts down human error and gives you up-to-the-minute visibility into your financial health. Digital solutions help teams boost productivity by 20%. Your team can focus on growth instead of manual data entry.

Your choice should depend on your business size, industry, and complexity. Small service-based businesses work well with user-friendly platforms like FreshBooks or ZipBooks. Multi-entity organizations with complex accounting needs might need Sage Intacct or NetSuite ERP. Cloud-based solutions work best for teams that need remote access and want to collaborate.

The cost matters when you pick bookkeeping software. Good news – quality options exist at every price point. You’ll find everything from free starter plans to enterprise-level solutions. Most platforms offer tiered pricing that grows with your business.

Note that bookkeeping software does more than keep financial records. The right solution turns raw data into useful insights through custom dashboards and detailed reporting. These insights help you make smart, informed decisions about purchases, expenses, and strategic growth.

You should assess your needs carefully before deciding. Think about user-friendliness, integration options, mobile access, and flexibility. On top of that, check if you need industry-specific features or if basic accounting tools are enough.

Smart bookkeeping solutions give you more than organized finances. They bring peace of mind, ensure compliance, and provide strategic clarity for your business trip. Today’s right choice builds the foundation for tomorrow’s financial success.